Navigating the Business Structure Maze

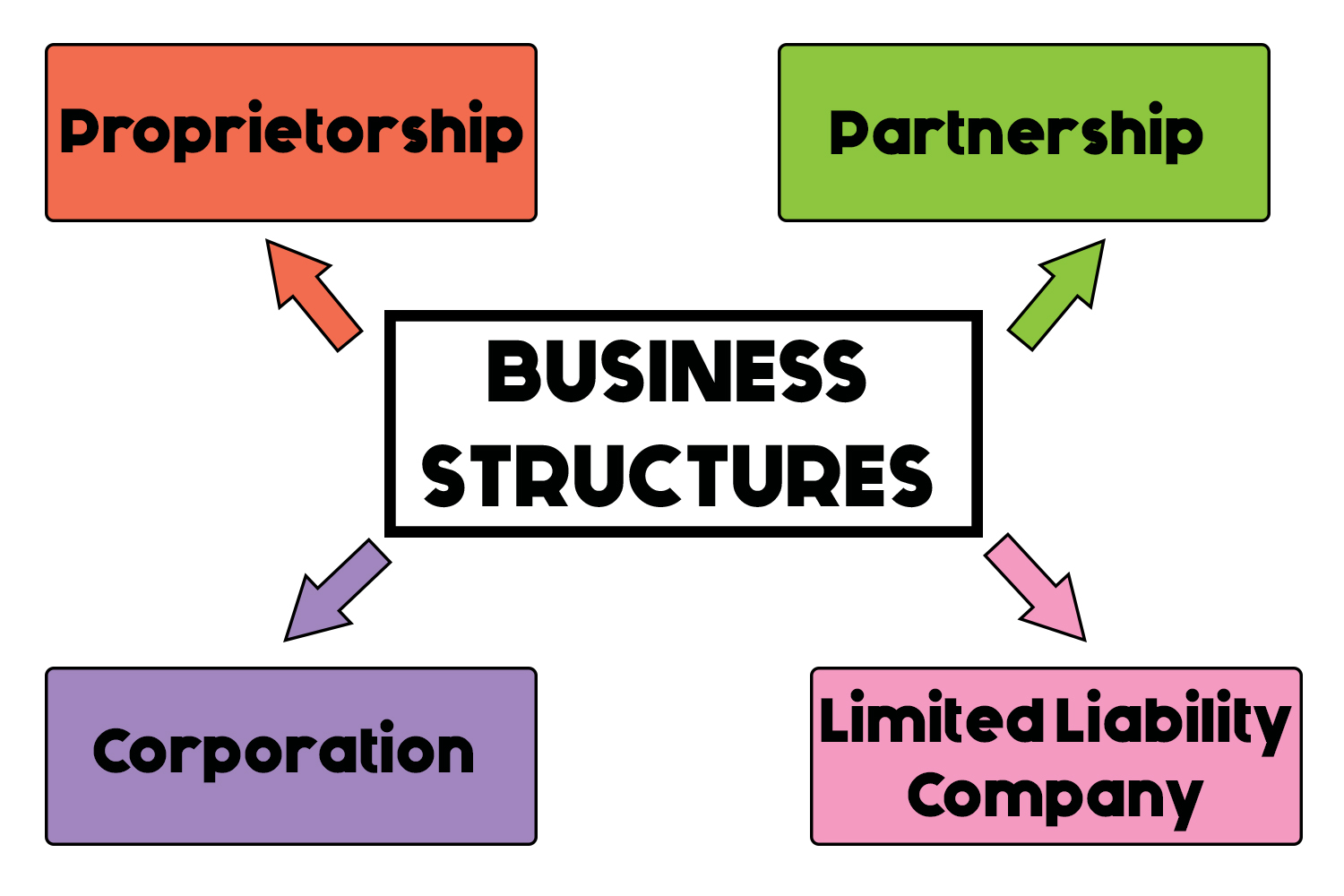

Starting a new business can be an exciting venture, but one of the most important decisions you will make is choosing the right business structure. With so many options available, navigating the business structure maze can be overwhelming. Each structure has its own set of advantages and disadvantages, and it’s crucial to understand them before making a decision.

One of the most common business structures is a sole proprietorship. This is the simplest form of business organization, where the business is owned and operated by one person. One of the biggest advantages of a sole proprietorship is that it is easy and inexpensive to set up. There are also fewer regulations and paperwork requirements compared to other structures. However, a major disadvantage is that the owner is personally liable for all debts and obligations of the business.

Another popular option is a partnership, where two or more individuals share ownership of the business. Partnerships can be general or limited, with each type having its own advantages and disadvantages. One of the benefits of a partnership is that the workload and financial responsibilities are shared among the partners. However, disagreements between partners can arise, leading to Potential conflicts and disruptions in the business.

Moving on to a more complex structure, a limited liability company (LLC) Combines the benefits of a corporation with the flexibility of a partnership. One of the advantages of an LLC is that owners have limited liability, meaning their personal assets are protected from business debts and lawsuits. Additionally, LLCs offer tax flexibility, allowing owners to choose how they want to be taxed. On the other hand, forming an LLC can be more costly and time-consuming compared to a sole proprietorship or partnership.

Image Source: licdn.com

For those looking to raise capital through investors, a corporation may be the best option. Corporations are separate legal entities from their owners, providing the owners with limited liability. This means that the owners’ personal assets are protected from the debts and liabilities of the business. Corporations also have the ability to issue stock, making it easier to attract investors. However, corporations are subject to double taxation, where the business profits are taxed at the corporate level and then again when distributed to shareholders as dividends.

Finally, there is the option of a cooperative, where ownership and control are shared among the members. Cooperatives are typically formed to meet the common needs of the members, such as purchasing goods or services at a lower cost. One of the advantages of a cooperative is that members have a say in the decision-making process and share in the profits. However, cooperatives can be complex to manage, as decisions must be made collectively by the members.

In conclusion, choosing the right business structure is a crucial decision that can have a significant impact on the success of your business. By understanding the advantages and disadvantages of each option, you can make an informed choice that aligns with your goals and aspirations. Whether you decide to go with a sole proprietorship, partnership, LLC, corporation, or cooperative, each structure offers unique benefits and challenges. So, take the time to explore the business structure maze and find the best fit for your entrepreneurial journey!

Uncovering the Pros and Cons of Each Option

When it comes to starting a business, one of the key decisions that entrepreneurs must make is choosing the right business structure. The business structure you select will have a significant impact on the way your business operates and how it is taxed. There are several options to choose from, each with its own set of advantages and disadvantages. In this article, we will take a closer look at some of the most common business structures and explore the pros and cons of each option.

1. Sole Proprietorship:

A sole proprietorship is the simplest form of business structure, where a single individual owns and operates the business. One of the key advantages of a sole proprietorship is that it is easy to set up and requires minimal paperwork. Additionally, the owner has complete control over the business and receives all profits. However, a major disadvantage of this structure is that the owner is personally liable for any debts or legal obligations of the business.

Image Source: foundersguide.com

2. Partnership:

A partnership is a business structure where two or more individuals share ownership of the business. One of the main advantages of a partnership is that the workload and financial burden are shared among the partners. Partnerships also benefit from the different skills and expertise that each partner brings to the table. However, a major disadvantage of a partnership is that the partners are jointly liable for the debts and obligations of the business, which can put personal assets at risk.

3. Limited Liability Company (LLC):

An LLC is a hybrid business structure that Combines the flexibility and tax benefits of a partnership with the limited liability protection of a corporation. One of the key advantages of an LLC is that it offers personal liability protection for the owners, meaning their personal assets are generally protected from business debts and lawsuits. Additionally, LLCs have flexibility in how they are taxed, allowing owners to choose between pass-through taxation or corporate taxation. However, setting up an LLC can be more complex and costly than other business structures.

4. Corporation:

A corporation is a separate legal entity that is owned by shareholders. One of the main advantages of a corporation is that it offers the highest level of personal liability protection for the owners, as their personal assets are typically shielded from business debts and lawsuits. Corporations also have the ability to raise capital through the sale of stock. However, a major disadvantage of a corporation is that it is subject to double taxation, where both the corporation and the shareholders are taxed on profits.

5. S Corporation:

An S corporation is a special type of corporation that allows for pass-through taxation, meaning profits and losses are passed through to the shareholders and taxed at their individual tax rates. One of the key advantages of an S corporation is that it offers personal liability protection for the owners while avoiding double taxation. However, S corporations are subject to certain restrictions, such as a limit on the number and type of shareholders, which can limit their flexibility.

In conclusion, each business structure has its own set of pros and cons, and the right choice will depend on the specific needs and goals of the business owner. It is important to carefully consider the advantages and disadvantages of each option before making a decision. By understanding the implications of each business structure, entrepreneurs can make an informed choice that will set their business up for success.

Choosing the Best Fit: Business Structure Options

![image.title Pros and cons of a company structure [infographic] image.title Pros and cons of a company structure [infographic]](http://cdn2.hubspot.net/hubfs/2108706/Downloadable_Documents/Infographics/Company.png)

Image Source: hubspot.net

When starting a new business, one of the most important decisions you will need to make is choosing the right business structure. There are several options available, each with its own advantages and drawbacks. In this article, we will analyze the different business structure options to help you determine which one is the best fit for your venture.

1. Sole Proprietorship

A sole proprietorship is the simplest form of business structure, where a single individual owns and operates the business. One of the main advantages of a sole proprietorship is that it is easy to set up and requires minimal paperwork. Additionally, the owner has complete control over the business and receives all profits.

However, there are also drawbacks to this business structure. One major disadvantage is that the owner is personally liable for any debts or legal obligations of the business. This means that if the business fails, the owner’s personal assets could be at risk. Additionally, it may be difficult for a sole proprietorship to raise capital or attract investors.

2. Partnership

A partnership is a business structure in which two or more individuals share ownership of the business. There are several types of partnerships, including general partnerships, limited partnerships, and limited liability partnerships. One of the advantages of a partnership is that it allows for shared decision-making and expertise.

However, partnerships also have their drawbacks. Like sole proprietorships, partners in a partnership are personally liable for the debts and obligations of the business. This means that each partner’s personal assets could be at risk. Additionally, disagreements between partners can lead to conflicts that may impact the business.

3. Corporation

A corporation is a separate legal entity that is owned by shareholders. One of the main advantages of a corporation is that it offers limited liability protection to its owners. This means that the personal assets of the shareholders are generally protected from the debts and obligations of the business. Additionally, corporations have the ability to raise capital through the sale of stock.

However, there are also drawbacks to forming a corporation. One major disadvantage is that corporations are subject to double taxation, meaning that profits are taxed at both the corporate level and the individual level when distributed to shareholders as dividends. Additionally, corporations are subject to more regulations and paperwork than other business structures.

4. Limited Liability Company (LLC)

A limited liability company (LLC) Combines the limited liability protection of a corporation with the flexibility and simplicity of a partnership. One of the main advantages of an LLC is that it offers limited liability protection to its owners, similar to a corporation. Additionally, LLCs have the flexibility to choose how they are taxed, either as a partnership or a corporation.

Despite the advantages of an LLC, there are also drawbacks to consider. One Potential disadvantage is that LLCs are more expensive to set up and maintain than sole proprietorships or partnerships. Additionally, some states have specific requirements for forming and operating an LLC, which can vary depending on the location of the business.

In conclusion, when choosing the best business structure for your venture, it is important to carefully consider the advantages and drawbacks of each option. Whether you decide to operate as a sole proprietorship, partnership, corporation, or LLC, each business structure has its own unique characteristics that may be better suited to your specific needs and goals. By analyzing the different business structure options, you can make an informed decision that sets your venture up for success.

Unleash Your Business’s Potential with Persuasive Messaging

In the competitive world of business, having a strong value proposition is essential for attracting and retaining customers. Your value proposition is essentially a promise to your customers – it tells them why they should choose your products or services over those of your competitors. Crafting a persuasive value proposition can truly unleash your business’s potential and set you apart in the marketplace.

One key aspect of creating a persuasive value proposition is focusing on the benefits that your products or services provide to your customers. Instead of simply listing features, think about how those features solve a problem or improve your customer’s life. For example, if you sell a time-saving app, instead of just saying it has a user-friendly interface, emphasize how it can help your customers save valuable time and increase productivity.

Another important element of persuasive messaging is understanding your target audience. You need to know who your ideal customers are, what their pain points are, and how your products or services can address those pain points. By tailoring your value proposition to resonate with your target audience, you can increase the likelihood of converting leads into customers.

In addition to focusing on benefits and understanding your audience, it’s also important to differentiate your business from competitors in your messaging. What makes your products or services unique? What sets you apart in the marketplace? Highlighting your unique selling proposition (USP) can help you stand out and attract customers who are looking for something different from the competition.

When crafting your value proposition, it’s important to keep it concise and to the point. Your messaging should be clear, compelling, and easy to understand. Avoid using industry jargon or technical language that may confuse or alienate potential customers. Instead, focus on communicating the value that your business provides in a simple and straightforward manner.

Furthermore, it’s crucial to test and iterate on your value proposition to ensure its effectiveness. Conducting A/B testing, gathering feedback from customers, and analyzing data can help you refine your messaging and make it more persuasive. By continuously optimizing your value proposition, you can ensure that it resonates with your target audience and drives results for your business.

In conclusion, crafting a persuasive value proposition is essential for unleashing your business’s potential and attracting customers. By focusing on benefits, understanding your audience, differentiating your business, keeping your messaging concise, and testing and iterating on your value proposition, you can create a compelling message that sets you apart in the marketplace. So, put in the effort to craft a value proposition that truly resonates with your target audience and watch as your business thrives and grows.

The Pros and Cons of Different Business Structures